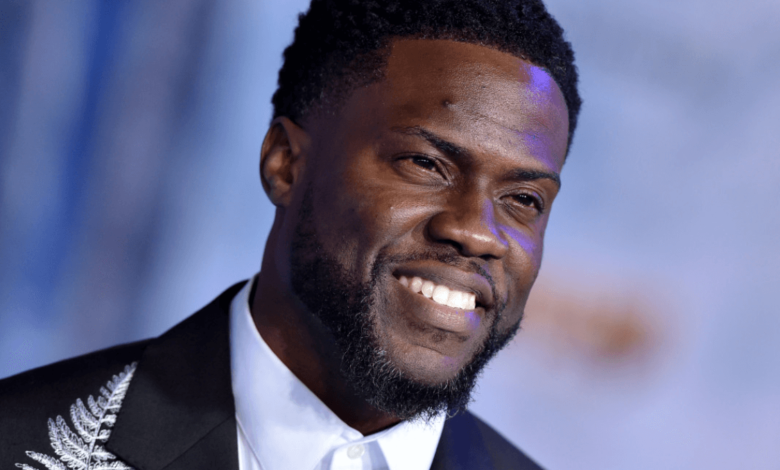

What Is Kevin’s Net Worth on May 31, 2013? Financial Flashback

As of May 31, 2013, What Is Kevin’s Net Worth was shaped by significant career milestones and a diverse portfolio of income sources. His entrepreneurial mindset allowed him to harness revenue from freelance projects while also benefiting from strategic investments in real estate and stocks. Despite facing challenges such as debt accumulation and income instability, Kevin’s proactive approach to financial management and market analysis contributed to his overall wealth growth. The economic context of 2013, marked by gradual recovery from the financial crisis, further influenced his financial landscape. To discover more about Kevin’s financial journey, keep exploring the details.

Kevin’s Career Milestones

Throughout his career, Kevin has achieved several significant milestones that have shaped his professional trajectory.

His career highlights include groundbreaking projects that revolutionized industry standards and major achievements that garnered prestigious awards, showcasing his commitment to excellence.

These accomplishments not only reflect his dedication but also inspire others seeking to forge their own paths toward professional freedom and success in their respective fields.

Income Sources in 2013

In 2013, various income sources contributed significantly to Kevin’s overall financial standing.

His diverse income portfolio included revenue from freelance projects, showcasing his ability to harness skills in multiple domains.

This entrepreneurial approach not only provided financial stability but also offered the freedom to explore creative avenues.

Kevin’s strategic focus on varied income streams positioned him favorably in an ever-changing economic landscape.

Key Investments Overview

In evaluating Kevin’s financial standing as of May 31, 2013, it is essential to examine his key investments, particularly in real estate ventures and stock market holdings.

These investment strategies not only reflect his financial acumen but also contribute significantly to his overall net worth.

Understanding the dynamics of these assets provides insight into the broader context of his wealth accumulation.

Real Estate Ventures

Navigating the complexities of the real estate market, Kevin has strategically positioned himself as a formidable investor with a keen eye for lucrative opportunities. His portfolio boasts luxury properties and innovative investment strategies, reflecting a commitment to financial independence.

| Property Type | Investment Strategy |

|---|---|

| Luxury Apartments | Long-term rental income |

| Commercial Spaces | Value-add renovations |

| Vacation Homes | Short-term rentals |

| Raw Land | Development potential |

Stock Market Holdings

Kevin’s stock market holdings reflect a diverse and strategic approach to wealth accumulation.

Through careful stock portfolio diversification, he aims to mitigate risks while capitalizing on emerging opportunities.

His investment strategy is grounded in rigorous market trend analysis, allowing him to adapt to fluctuations and maintain a robust financial position.

This proactive stance empowers him to achieve greater financial freedom and long-term growth.

Read more: Todrick Hall Net Worth: Entertainer’s Career Earnings Revealed

Financial Challenges Faced

In examining Kevin’s financial landscape as of May 31, 2013, several challenges emerge that have significantly impacted his net worth.

Key issues include the accumulation of debt, factors contributing to income instability, and various missteps in investment strategies.

These elements collectively underscore the complexities of managing personal finances in an ever-changing economic environment.

Debt Accumulation Issues

Frequently, individuals facing financial challenges encounter significant issues related to debt accumulation.

To navigate this struggle effectively, it is essential to prioritize financial literacy and implement effective debt reduction strategies.

Consider the following:

- Create a budget.

- Identify high-interest debts.

- Negotiate lower interest rates.

- Explore consolidation options.

Embracing these principles can empower individuals to reclaim their financial freedom and reduce their debt burden.

Income Instability Factors

Financial insecurity often stems from various income instability factors that can create significant challenges for individuals.

The unpredictable nature of a volatile market can lead to fluctuations in earnings, impacting financial stability.

Additionally, career transitions may disrupt steady income streams, forcing individuals to adapt quickly.

Such elements can hinder the pursuit of financial freedom, necessitating careful planning and resilience to navigate these uncertainties.

Investment Missteps Overview

While the potential for significant returns often attracts investors, missteps in investment decisions can lead to substantial financial challenges.

Common investment mistakes include:

- Neglecting research before investing.

- Overreacting to market volatility.

- Putting all funds into a single asset.

- Ignoring diversification principles.

These financial lessons highlight the importance of thoughtful strategies to achieve true freedom in investing.

Comparing Net Worth Over Time

Over the years, many individuals have experienced fluctuations in their net worth, reflecting the dynamic nature of personal finances.

Historical comparisons reveal that financial trends often shift due to various factors, including market conditions and investment choices.

Economic Context of 2013

The economic landscape of 2013 was marked by a slow but steady recovery from the global financial crisis of 2007-2008.

Key economic trends included:

- Gradual GDP growth

- Moderate unemployment reduction

- Increased consumer confidence

- Volatile market fluctuations

These factors shaped investment decisions, highlighting the importance of adaptability for individuals seeking financial freedom amidst a recovering economy.

Read more: Spencer Barbosa Net Worth: Influencer’s Career Earnings

Conclusion

In summary, What Is Kevin’s Net Worth financial journey on May 31, 2013, reflects a complex interplay of career achievements and economic challenges. While diverse income sources and strategic investments contributed positively, financial obstacles necessitated careful navigation. Like a ship weathering a storm, Kevin’s resilience and adaptability underscored the importance of fiscal prudence in an unpredictable economic landscape. Ultimately, understanding this period provides valuable insights into the dynamics of wealth accumulation and the critical factors influencing net worth over time.